Home Hub

Home Hub 5% Deposit Scheme opens more doors for first-time buyers

Exciting news for first home buyers! The Australian Government’s 5% Deposit Scheme was expanded on 1 October 2025. We look at what it can mean for your buying plans.

Saving the traditional 20% deposit can be one of the key challenges when it comes to buying a first home.

For many first-time buyers, that process is more of a marathon than a sprint.

According to research firm Cotality, it now takes around 10-years-plus to save a 20% deposit1.

Who has the sort of time to wait?

Over a 10-year timeframe, property values are likely to have surged higher, meaning buyers are constantly seeing their goal posts shift further away.

And if you’re renting, a 10-year saving period means considerably more of your money is going to the landlord – cash you could be using to pay off your own home.

That’s where the expanded 5% Deposit Scheme offers a win-win solution.

How the 5% Deposit Scheme works

The 5% Deposit Scheme offers two big benefits.

It takes a lot less time to grow a 5% deposit than, say, a 20% deposit. So you can get into your first home sooner (It’s important to note, it also means you’re taking on a higher level of debt, borrowing around 95% of the property’s value rather than 80%.)

In addition, the federal government guarantees the lender, so there is no need to pay lenders mortgage insurance (LMI) – a cost that would normally apply for borrowers with a deposit below 20%.

What changes have been made to the 5% Deposit Scheme?

All first homebuyers who have saved a 5% deposit (or a minimum of 2% for single parents) are now eligible to access the Scheme.

Income limits have been scrapped, so it doesn’t matter how much you or your partner (if you’re buying together) earn.

The annual limit on the number of places available has also been removed.

This means more Australians can access the Scheme and get into a place of their own sooner.

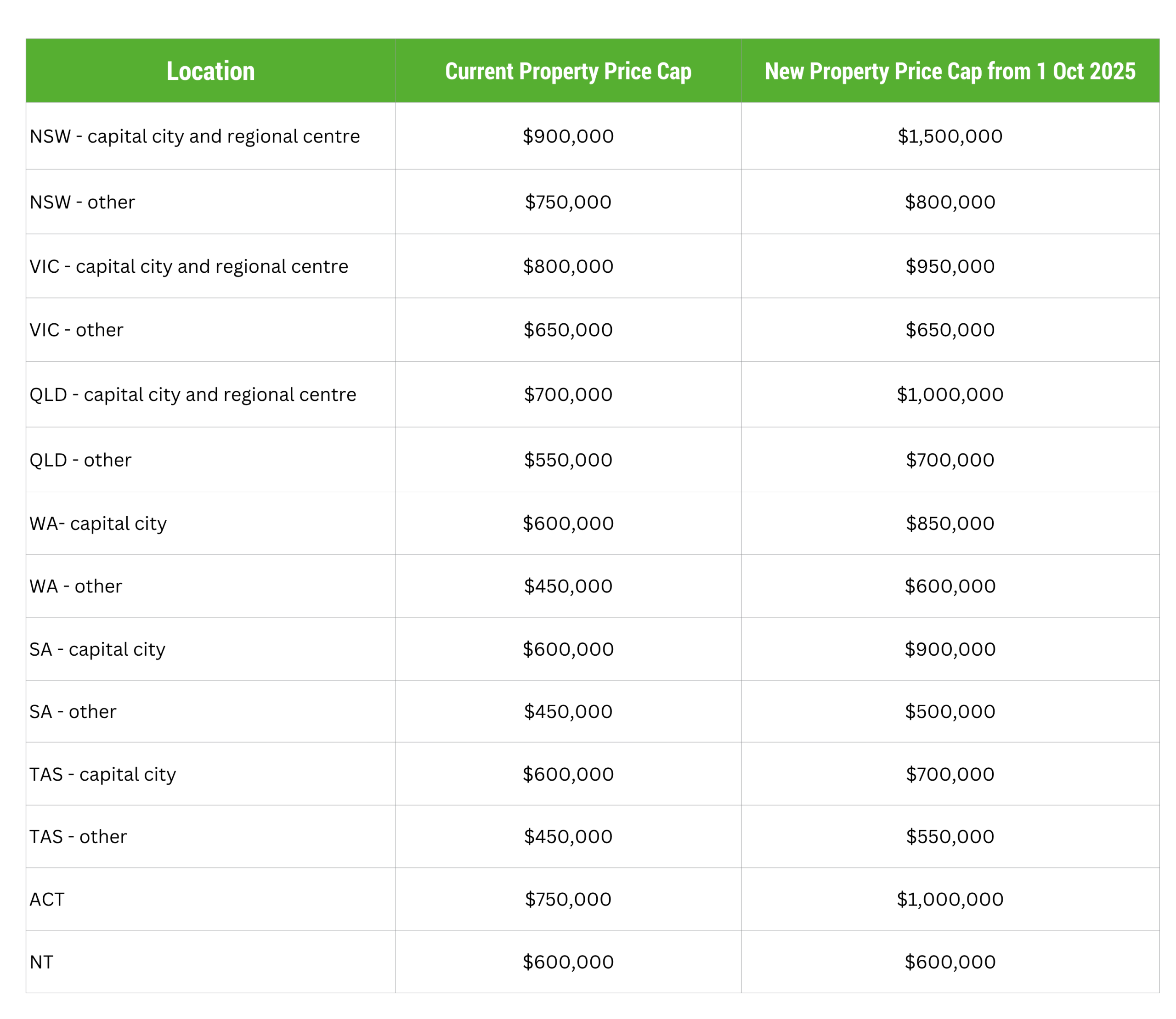

Property price limits still apply under the 5% Deposit Scheme. However, the price caps have been increased in line with average house prices (see Table 1 below).

Table 1: Property cap changes from 1 October 2025

Source: https://firsthomebuyers.gov.au/australian-government-5-percent-deposit-scheme/property-price-caps

Get into your first home up to 10 years sooner

There’s a lot to love about the newly expanded 5% Deposit Scheme.

It gives first homebuyers a chance to get into the market before property prices rise higher, and this can also deliver savings on rent.

Without the need to pay LMI, first homebuyers also face lower upfront buying costs. That said, it’s still important to budget for other buying expenses such as stamp duty (where applicable), legal fees and pre-purchase inspections.

Even so, the scheme can considerably fast-track your buying plans.

A first homebuyer in Brisbane, for example, can now purchase a $1 million home with a $50,000 deposit, slashing up to 10 years off the time it takes to save a deposit – and saving about $42,000 in LMI2.

Regional first homebuyers benefit too. A first home buyer in Bendigo could purchase a $600,000 home with only a $30,000 deposit, saving up to six years off the time it takes to save a deposit, and bypassing what could otherwise be a $25,000 LMI premium3.

Is there a catch?

Not all lenders have signed up to the 5% Deposit Scheme.

That’s why it’s important to talk to Community First Bank.

We have long supported the Scheme – a reflection of our commitment to help our members enjoy the rewards of home ownership.

Talk to us – we’ll get the ball rolling

Looking to buy your first home?

The team at Community First is here to help you achieve your goal.

To get the ball rolling, call us on 1300 13 22 77 (Mon-Fri 8am-8pm, Sat 8am-3pm) or visit any of our stores for more information.

Credit eligibility criteria, terms & conditions, fees & charges apply

References:

1https://hia.com.au/our-industry/newsroom/industry-policy/2025/08/home-ownership-scheme-expansion-a-boost-for-first-home-buyers?

2https://www.pm.gov.au/media/albanese-government-delivers-5-deposits-all-first-home-buyers-sooner

1300 13 22 77

1300 13 22 77